Our portfolio

FGEN owns 39 assets located across stable and mature European markets, with a primary focus on the UK.

Overview

The portfolio is invested across three key pillars of environmental infrastructure:

-

Renewable energy generation

-

Other energy infrastructure, and

-

Sustainable resource management

Sector split

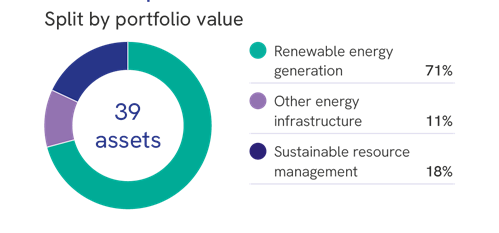

Split by portfolio value

Renewable energy generation

The bedrock of FGEN’s portfolio characterised by stable, predictable cash flows, inflation linkage and often supported by government subsidies or other regulatory mechanisms given their criticality to the decarbonisation agenda. Assets include wind, solar, anaerobic digestion, biomass, energy-from-waste and hydro.

- 6 asset classes

- 31 assets

- 71% share of portfolio value

Wind

Learn moreSolar

Learn moreAnaerobic digestion

Learn moreWaste and bioenergy

Learn moreHydro

Learn moreOther energy infrastructure

Non-energy generating assets that support the transition towards net zero, driven by increased demand for electrification and supported by legislation. This segment includes our battery storage units and low‑carbon transport.

- 2 asset classes

- 4 assets

- 11% share of portfolio value

Battery energy storage

Learn moreCNG Fuels

Learn moreSustainable resource management

Sustainable resource management means applying sustainable practices to ensure that resources benefit both current and future generations. This includes areas such as waste and wastewater treatment, as well as sustainability enhanced controlled environment agriculture and aquaculture activities.

- 2 assets classes

- 4 assets

- 18% share of portfolio value

Waste and wastewater

Learn moreControlled environment

Learn moreLocations

Asset Name

Location

Asset type

Acquisition date

bdndnrdngnt